Business Insurance in and around Malvern

One of the top small business insurance companies in Malvern, and beyond.

Cover all the bases for your small business

Insure The Business You've Built.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all alone. As someone who also runs a business, State Farm agent OA Paul recognizes the work that it takes and would love to help lift some of the burden. This is coverage you'll definitely want to consider.

One of the top small business insurance companies in Malvern, and beyond.

Cover all the bases for your small business

Small Business Insurance You Can Count On

Whether you are a dog groomer a drywall installer, or you own a beauty salon, State Farm may cover you. After all, we've been into small business insurance since 1935! State Farm agent OA Paul can help you discover coverage that's right for you and your business. Your business policy can cover things such as buildings you own and loss of income and extra expense.

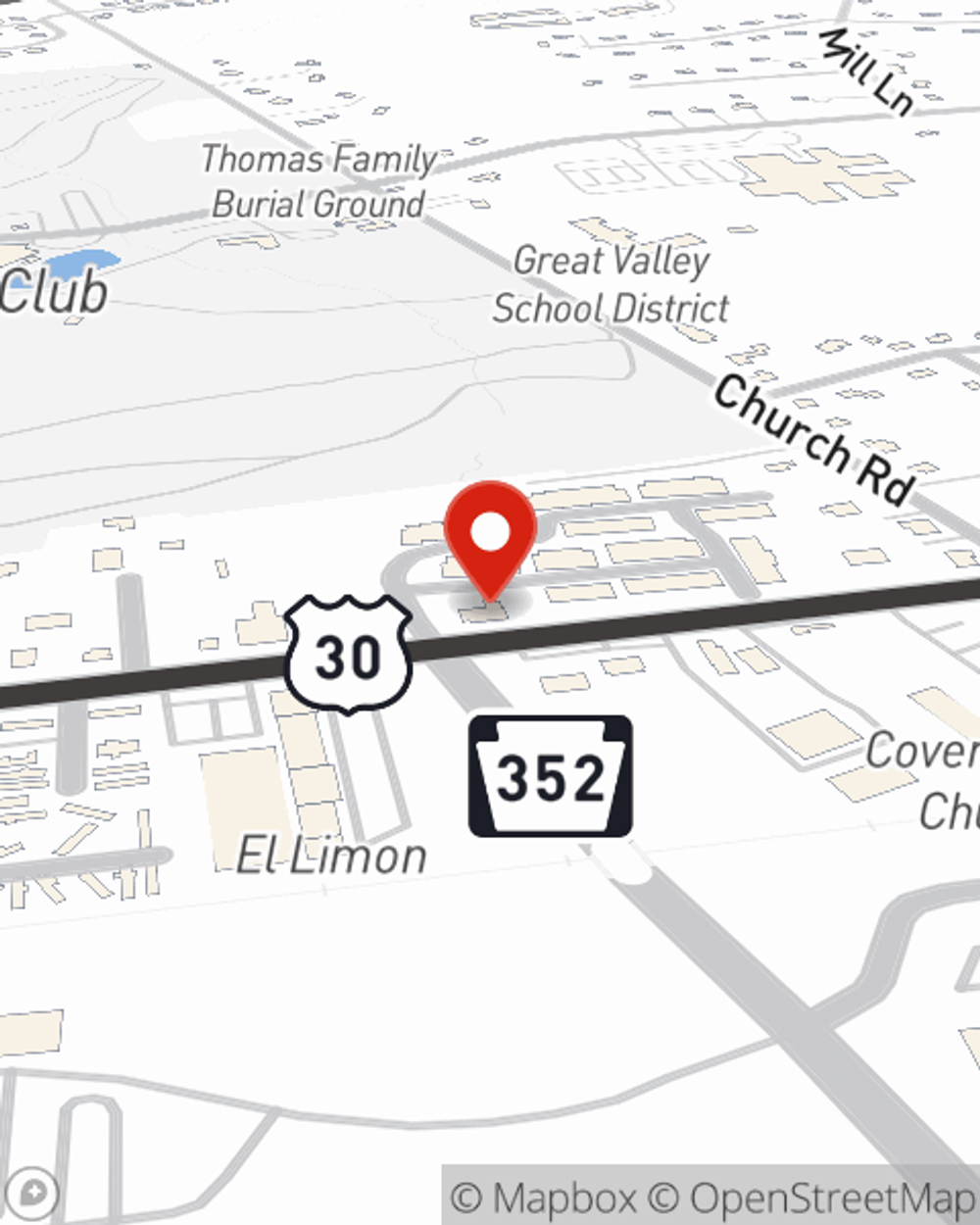

Visit State Farm agent OA Paul today to learn more about how one of the leaders in small business insurance can ease your worries about the future here in Malvern, PA.

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

OA Paul

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?